UPDATE: ON NOVEMBER 1, 2023, I FILED A LAWSUIT IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND AGAINST 30 companies PARADING AS MARKET MAKERS AT THE NATION’S SECURITIES EXCHANGES for violating the CFAA, Sherman Act, federal securities laws and Maryland state laws. Webull Financial is the 31st defendant and the suit against the broker is interwoven but the claims are varied. THE SUIT NUMBER IS: 8:23-CV-02986-LKJ. The SCHEME revolved around the securities of Lordstown Motors (RIDE), Ashford Hospitality Trust (AHT), Multiplan Corporation (MPLN), Genius Group (GNS). The MARKET MAKERS conspired and coordinated in the fraud/crime to hack my personal computers, stalk and monitor me, stole financial records and data, and used the stolen information to manipulate securities held in my portfolio, including driving Lordstown Motors into bankruptcy protection. WeBull Financial Assisted them with DECEIT, SELF-DEALING, VARIOUS BREACHES, and Broken or Manipulated Technology. In the week following and including the date of the lawsuit, video evidence showed the Market Makers and employees/agents of the Defendants frantically manipulating GNS, AHT, RIDEQ as they monitored three Yahoo Finance browsers on my computers, paralleled and gamified the stocks. *************************************************************************************

UPDATE TO Civil Action Number: 23-cv-02986-LKG (USDC Md.), Judekenneth Maduka Orji v, Citadel Securities, LLC, et al.

DATE FILED: November 1, 2023

CASE STATUS: ONGOING, SEE COURT DOCKET, COURTLISTERNER

CRIMINAL CHARACTER OF ALLEGATIONS:

Though this case is a civil action, the fraud and conduct of the defendants constitute criminal offences under both Federal Law and Maryland Law. It is a federal crime to engage in the hacking of any computer or network. It is a Maryland state crime to engage in the hacking of any computer/network – felonious where the amount of loss equals or exceeds the losses caused by Defendants in the present case. It is a federal crime to engage in acts that are prohibited by the Sherman Antitrust Act, which Defendants did in this matter. The federal RICO laws prohibit the kind of scheme Defendants are engaged - which forms part of this lawsuit. I used “are” to show that Defendants have intensified the cyber-hacking of Plaintiff’s computers since the filing of the lawsuit, and Plaintiff has been collecting a treasure trove of evidence which he would share with any interested party or regulator or law enforcement. ***THESE CRIMES ARE OCCURING IN THE UNITED STATES***

DEFENDANTS:

Citadel Securities, LLC; Goldman Sachs & Co., LLC; GTS Securities, LLC; Canaccord Genuity, Inc.; Susquehanna Securities, Inc.; Cowen & Company, LLC; Robert W. Baird & Co., Inc.; IMC Financial Markets, LLC; Latour Trading, LLC; G1 Execution Services, LLC; Cantor Fitzgerald & Co.; Two Sigma Securities, LLC; SG American Securities, LLC; Morgan Stanley & Co, LLC; J. P. Morgan Securities, LLC; Clear Street, LLC; Stifel, Nicolaus & Co., Inc.; Wells Fargo Securities, LLC; William Blair, LLC a/k/a William Blair & Co., LLC; UBS Securities, LLC; Keefe, Bruyette & Woods, Inc.; BOFA Securities, Inc.; Maxim Group, LLC; Keybanc Capital Markets, Inc.; StoneX Financial Inc.; PUMA Capital, LLC; HRT Financial, LP; Flow Traders US Institutional Trading LLC; and Wolverine Trading, LLC. The defendants are market makers in certain publicly traded securities, including Ashford Hospitality Trust, Inc. (AHT), Lordstown Motors, Inc. (RIDEQ), Genius Group, Ltd. (GNS), and Multiplan Corporation (MPLN).

SUMMARY OF ALLEGATIONS:

The lawsuit alleges that the defendants conspired to obtain my identify from the Internet, stalk me, hacked into my personal computers, internal network, and mobile phones that are connected to my network, obtained financial records of my brokerage accounts, devised and embarked on a fraudulent scheme to manipulate securities in my portfolio in order to deceive and defraud me. The lawsuit alleges violation of the Computer Fraud and Abuse Act, 18 U.S.C. 1030, the antifraud provisions of the Securities Exchange Act of 1934, the Sherman Act, and Intentional Infliction of Emotional Distress under Maryland state law.

SELECTED MANIFESTATIONS OF DEFENDANTS FRAUDULENT SCHEME/CONDUCTS:

*** Stalking Plaintiff, obtaining his email identity and footprints

*** Cloning and creating multiple and various email accounts identical to Plaintiff’s

*** Cloning Plaintiff’s family members’ email accounts, including kids’ accounts

*** Making Plaintiff’s email accounts the recovery email for their cloned accounts

*** Sending recovery email messages with codes to Plaintiff’s accounts

*** Using the codes to enter Plaintiff’s accounts, computers and network

*** Changing Plaintiff’s email password in attempts to log him out

*** Changing Plaintiff’s X (Twitter) account settings to hide exposing posts

*** Tracking Plaintiff’s social media accounts to assume login control

*** Assigning dedicated employees to monitor Plaintiff’s 24-hours

*** Monitoring Plaintiff’s work, employment, remuneration, banking

*** Reading clients confidential and privileged data on Plaintiff’s device screens

*** Most clients are public companies, so another motive to stay and steal their secrets

*** Defendants used sophisticated apps to remotely control Plaintiff’s devices/network

*** Defendants see Plaintiff’s login into all accounts, see what Plaintiff has on screen

*** Obtaining specific information about securities in Plaintiff’s brokerage accounts

*** Defendants embarked on the targeted manipulation of the securities in account

*** Stalking, monitoring, and observing Plaintiff’s use of his mobile phones

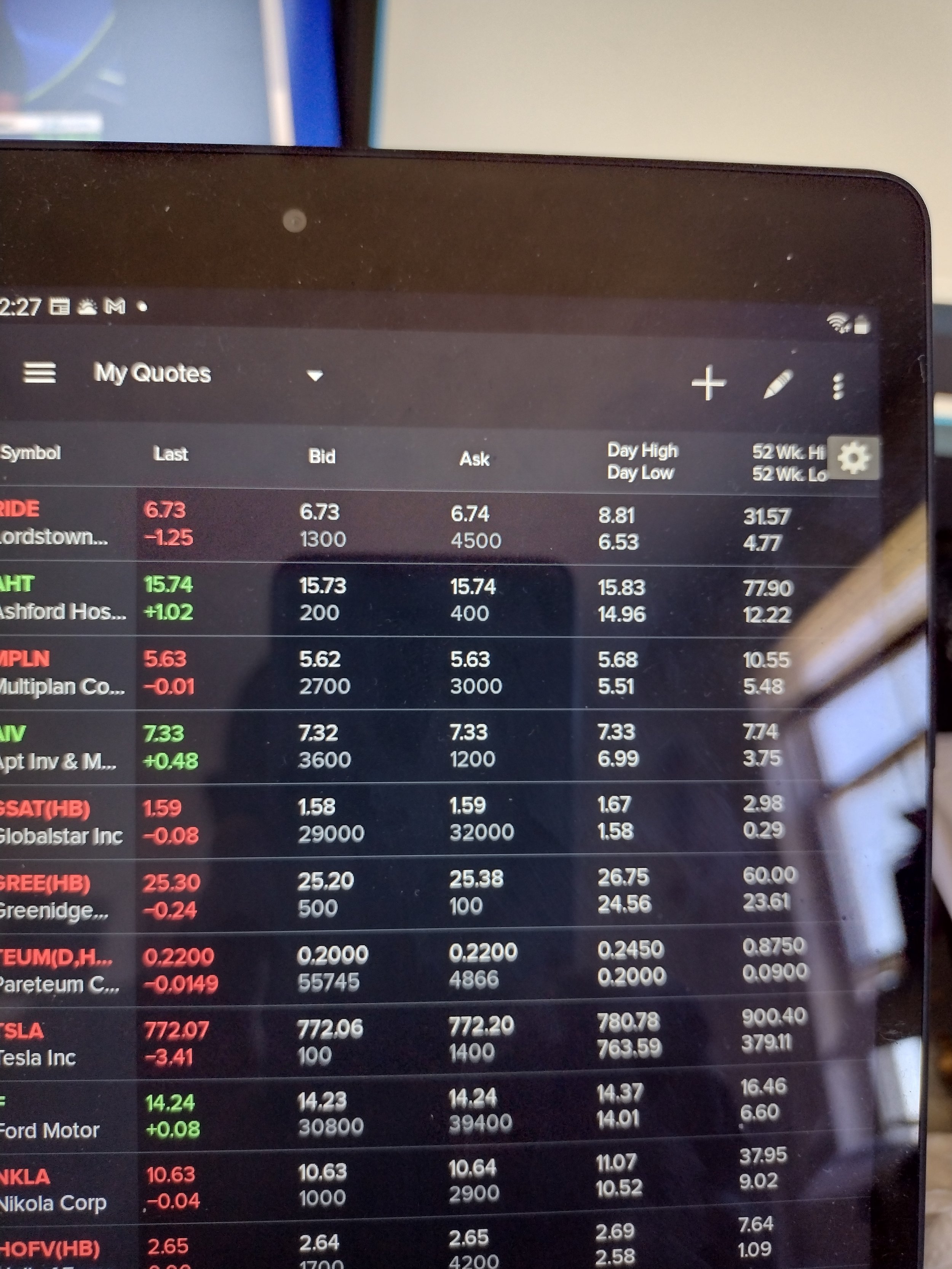

*** Monitoring Plaintiff’s use of a TradeStation Watchlist app on Mobile phone

*** Watchlist has 16 stocks -capacity, but Defendants fixed the quotations of four

*** The 12 other stocks were never fixed at any time in the data collected by plaintiff

*** The quotation price fixing occurred whenever Plaintiff monitored the Watchlist

*** The quotation price fixing occurred throughout the relevant period

*** The four constituted 99 percent of securities in Plaintiff’s portfolio

*** Next, Defendants adopted a course of business to sell down portfolio assets

*** Defendants employed their options privileges as market makers for this purpose

*** Plaintiff sold covered call options to hedge against all securities positions

*** Defendants has obtained portfolio data through hacking access to PC/phone screens

*** Defendants would place quotations on the options to depress the account values

*** EASY STUFF. Options exchange systems do set arbitrary prices based on quotations

*** Defendants adopted this DAILY course of business for 5 MONTHS against ACCT

*** Defendants quoted various manipulative prices based on underlying security status

*** Defendants’ quotation spread depended on underlying stocks trading up or down

*** Either way, intent and effect were to depress account value, trigger margin, defraud

*** Defendants would monitor Plaintiff’s funding of the account, and strategize

*** Defendants would manipulate the accounts to discount any new funding impact

*** Through a coordinated action with Webull, Defendants deceived/defrauded Plaintiff

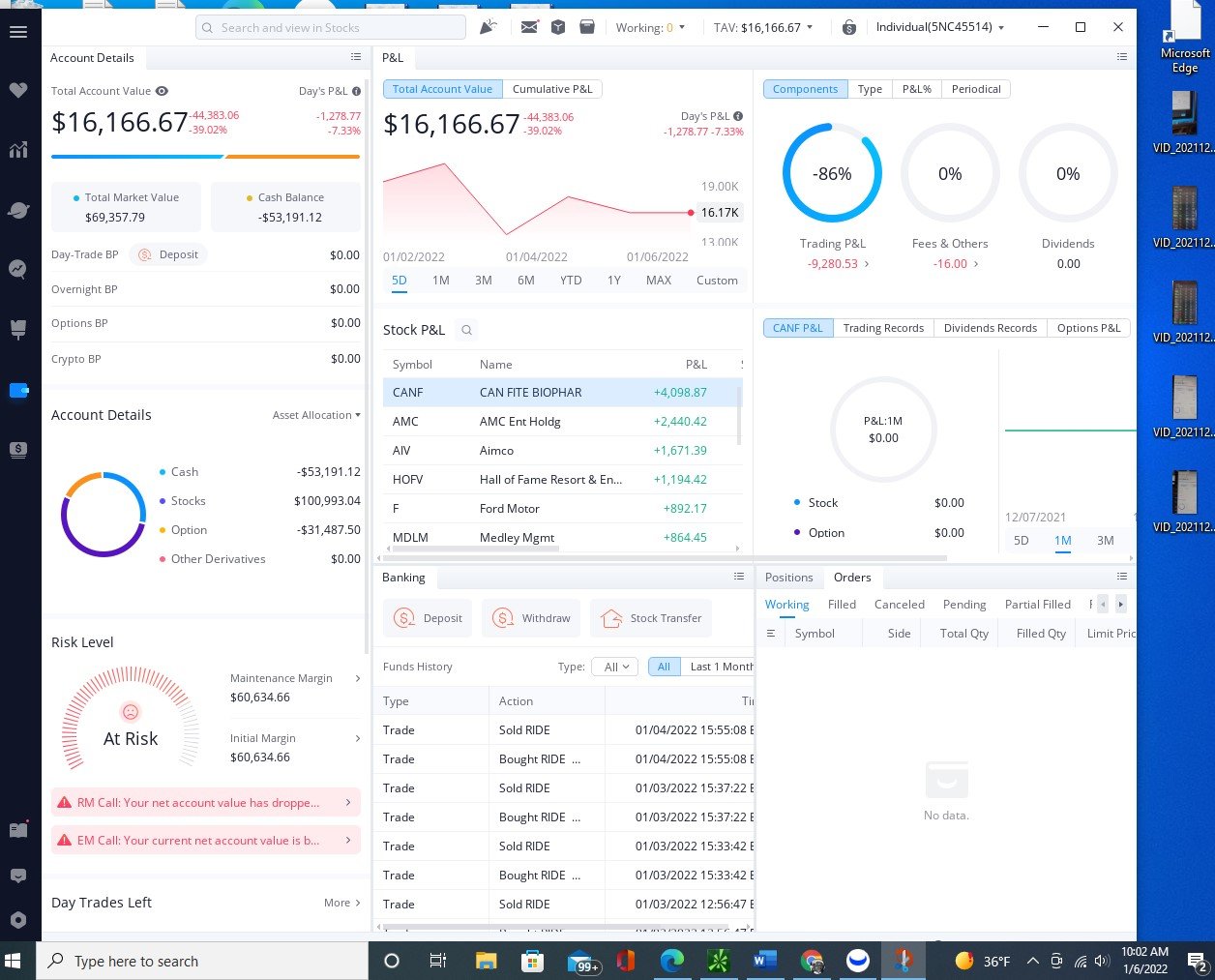

*** Defendants continued the fraud scheme with TD Ameritrade and Schwab Accounts

*** Defendants adopted the same options modus operandi on Schwab/TD portfolios

*** Defendants would manipulate 2-cents options into $50 just to depress Plaintiff’s Act

*** Defendants would pay $0.93 for $3 Options Strike as RIDE traded at $1 (Jan 2023)

*** Defendants used mkt privileges to impose multiple million-dollar losses on portfolio

*** For 7 months, Defendants ensured that the portfolio was negative irrespective of whether the underlying stocks traded up or down

***When Defendants are unable to depress margin, they attack the broader stocks

*** Defendants coordinated with John Does to drive Lordstown Motors into Bankruptcy

*** Defendants ensured that Lordstown Motors was unable to raise money from Mkts

*** Plaintiff got multiple home networks, multiple mobile phones trying to over the hack

*** When Plaintiff got Pixel 7, Defendants detected it, immediately sent GMAIL code

*** Pixel 7 has a unique feature to show the location of access to the phone

*** In Aug 2023, Plaintiff saw that the Pixel was being accessed from Singapore

*** Recorded video showed Defendants stalking Plaintiff’s stk purchase on Schwab

*** Plaintiff reset the phone. Later, Plaintiff discovered that Citadel has Singapore office

*** Plaintiff believes that the hacking of his network was from Citadel’s Singapore office

*** Post Lordstwon Motors, Defendants turned to AHT (See the chart from July 2023)

*** After Plaintiff got AHT options in Aug 2023, Defendants kept it below strike price

*** AHT trading was almost halted just to expire Plaintiff’s options worthless

*** Above was despite AHT improvements, just like despite Lordstown’s ENDURANCE

*** AHT was kept between $2.00-$2.50 being the strike price of Plaintiff’s options

*** After Plaintiff amended complaint on AHT in Dec 2023, Defendants sold AHT down

*** Plaintiff bought several thousand AHT from Dec 2023. Defendants tracked the buys

*** Defendants continued selling AHT down to $1.25 as Plaintiff bought the shares

*** Check the chart/trading on GNS before and after October 2023 for Fraud-in-Motion

*** From Feb 2023 when Plaintiff got it, Defendants engaged in coordinated fraud on it

*** In the midst of this fraud, Defendants through Citadel Advisors, got 19800 options

*** Every movement on GNS from March 2023 is tied to Plaintiff’s portfolio activities

*** As Plaintiff prepared to file the lawsuit in October 2023, Defendants sold GNS down

*** After the lawsuit was filed on November 1, brought GNS lower each day till $0.51

*** On the last $0.51’s day, Plaintiff added at that price. Defendants removed all quotes

*** Defendants were obligated to quote at all times, nut broke regulation bc of this fraud

***On that same day, Defendants brought AHT to $1.52 after Plaintiff bought AHT at $1.60

***The 1.52 on AHT was all-time-low on that same day as Defendants removed GNS quotes

*** Next trading day, GNS sold shares at $0.34, Defendants coordinated to send it to $0.27

*** When Plaintiff opened Yahoo, Defendants had AHT at $1.60

*** After Plaintiff closed the browsers, Defendants started selling down AHT with GNS

*** Defendants sold the AHT to $1.25 in the coming days, while holding GNS at $0.26

*** The next day after GNS announced revenue expectation, Plaintiff bought more at $0.37

*** As Defendants bought GNS, they brought up AHT too. Plaintiff got AHT at $1.46

*** Since then, AHT has announced plan to pay off strategic debt, ran up, but sold back down

*** That strategic financing was the only overhang on the stock, see company releases

*** AHT ran to $1.89 on heavy volume following the announcement as Defendants sold it

*** Defendants sold AHT and GNS back to exactly the last prices Plaintiff bought them

*** A 2-Months chart of GNS, AHT, RIDEQ will show a rise at 9.30 am, then drop back down

*** Each drop coincides with Defendants monitoring Plaintiff as he opened Yahoo browsers

*** Defendants’ hacking of my computers has intensified since the lawsuit

*** Plaintiff recorded multiple videos showing Defendants arranging quotations on RIDE/AHT/GNS as he reviewed the complaint, or communicated with his lawyers both before, during and after the filing of the lawsuit

*** A 3-month chart of AHT/RIDEQ/GNS from 11/1/2023 will reveal Defendants’ fraud

*** Defendants sent various malware to destroy my flash drives as I created their fraud data

*** On the days when I added AHT/GNS, Defendants remotely froze my login to Ally Acct

*** On multiple times, it took over 23 minutes for Ally account to open as Defendants froze it

*** Whenever Plaintiff engaged in his work, Defendants remotely freeze the work platforms

*** On multiple times, Plaintiff contacted colleagues and IT about issues with his platform

*** In one instance, IT responded that it was unable to recreate the issue-causing scenario

*** Multiple times, Defendants quoted AHT/RIDE/GNS while monitoring Plaintiff’s ACT login

*** 3 days after MM’s dropped RIDEQ from $4, Plaintiff tried to move money into Ally Acct

*** At 10.40 am, Defendants ran RIDEQ to $1.73 from $1.25, waited for Plaintiff to buy more

*** It took 4 hours for money to post on Ally. Plaintiff got at $1.53; RIDEQ closed at $1.35

***The next day, Defendants took RIDEQ to $1.18, and eventually to $0.92 in days ahead

*** A simple Yahoo chart will verify the movement of RIDEQ to $1.73 and back down

*** FAST FORWARD TO FEB 16, 2024: Defendants took AHT down to $1.66 at 9.30 am

*** Plaintiff had just opened Yahoo Finance browsers as usual on AHT/GNS/RIDEQ

*** Defendants slammed AHT to $1.56 as Plaintiff opened a favorite video, “Citadel: The Cancer of U.S. Stock Markets” on YouTube as seen here: https://www.youtube.com/watch?v=xd7akKmVA8I

*** As Plaintiff played the video repeatedly, Defendants watched and sold AHT to $1.53

*** Between 9.34 am to 1.40 pm, Defendants held AHT at $1.54ish. Plaintiff got a Reddit alert

*** At 1.1 pm, as Plaintiff typed to post on Reddit Daytrading, Defendants took AHT to $1.58

*** AHT had been at $1.54 till the Reddit alert. (Check the Yahoo Chart on the movement)

*** Meanwhile, as AHT was down at $1.54, Defendants ensured that GNS was under $0.40

*** The GNS suppression was despite multiple posts of good news by Roger Hamilton on X

*** Following Reddit, Plaintiff started logging into his X @Chieforji Account at 1.51 pm

*** Defendants observed the login on the PC screen and took AHT to $1.61, a 4-hour high

*** After I posted a message on Roger Hamilton handle, Defendants took AHT to $1.65

*** Plaintiff then decided to call AHT corporate office. As the call rang, they sold AHT

*** After the AHT call, Defendants observed my composition of an email with a screenshot of the AHT call-time, and sold both AHT/GNS/RIDEQ to $1.60, $0.38, and $1.35, before closing them slightly higher at 4.00 pm.

UPDATES TO BE CONTINUED

Securities Fraud: How Market Makers and Co-conspirators Led by CITADEL SECURITIES, SUSQUEHANNA SECURITIES, GTS SECURITIES, VIRTU AMERICAS and Convicted Criminal Entity, GOLDMAN SACHS (See DOJ PR, 4/8/22 ) Engaged in Potential Criminal Misconducts to Steal my Identity, Hack my Computers, Phones, Network, Obtain Brokerage Account Data, and Engaged in a Course of Business to Deceive and Defraud! They Continue this Scheme as at the Time of this Update.

A group of market makers, hedge funds, and brokers, led by CITADEL SECURITIES, GOLDMAN SACHS, GTS SECURITIES associated themselves for the purpose of stalking, targeting, and trading against my portfolio by manipulatively trading any securities and derivatives they tracked to my brokerage accounts. The goal was to either frustrate me out of the market, or manipulate positions in the account to destroy the value. Five of these market makers, including Citadel Securities and GTX Securities, had to abandon making market in an insurance company stock barely three weeks of enlisting because I owed a lot of the shares. In 2021, they focused on AHT, MPLN and RIDE (added GNS in 2023), manipulating the stocks and options they traced to me. These fraudulent companies continue the fraud, coordinating to short, manipulate stocks I own or purchase (from the moment of account activity) on a daily basis, as their course of business. Follow updates on Twitter: @igbo_man! See more videos at the YouTube Channel: ExchangeMarketMakerFraud.

17 C.F.R § 240.10b-5(a)-(c), prohibits using any scheme, device, or contrivance to deceive or defraud anyone in the purchase and sell of securities. See full text next page.

Due to ongoing investigations and impending litigation. only introductory data is shared on this website. A book with complete details of this brazen and willful fraud will be available. WATCH OUT!

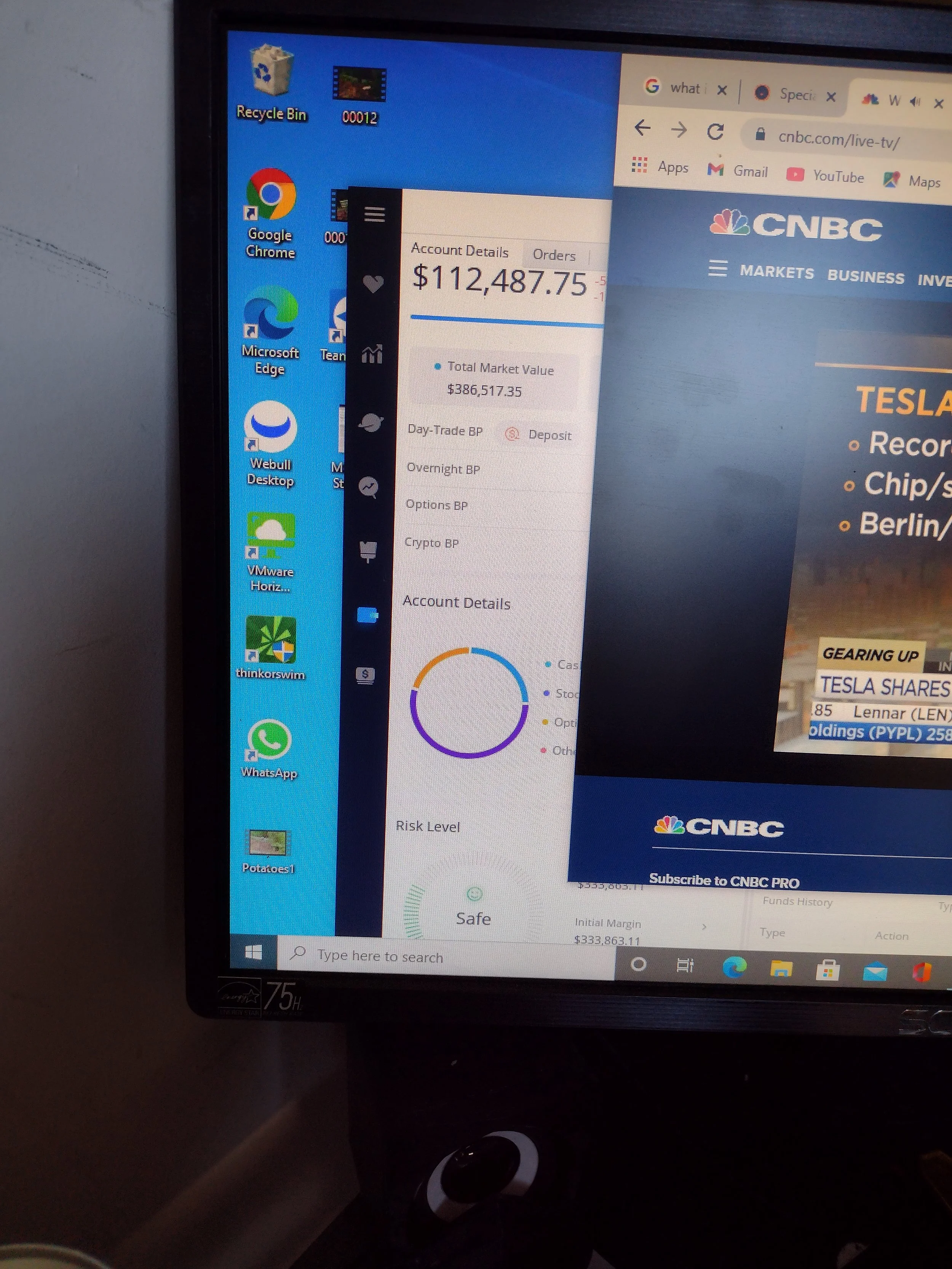

As the 38 Market Makers/Paticipants of RIDE, AHT, MPLN worked against me, WeBull Financial, Inc. Joined with Faulty Technology and Wiped Out My NAV!

WEBULL ACCOUNT PRIMARY TARGET

On November 26, 2021, Webull Financial Services was notified in writing. More than 100 Gigabytes of data were provided to Webull. Webull responded that it has launched full investigation. The book will have full details.

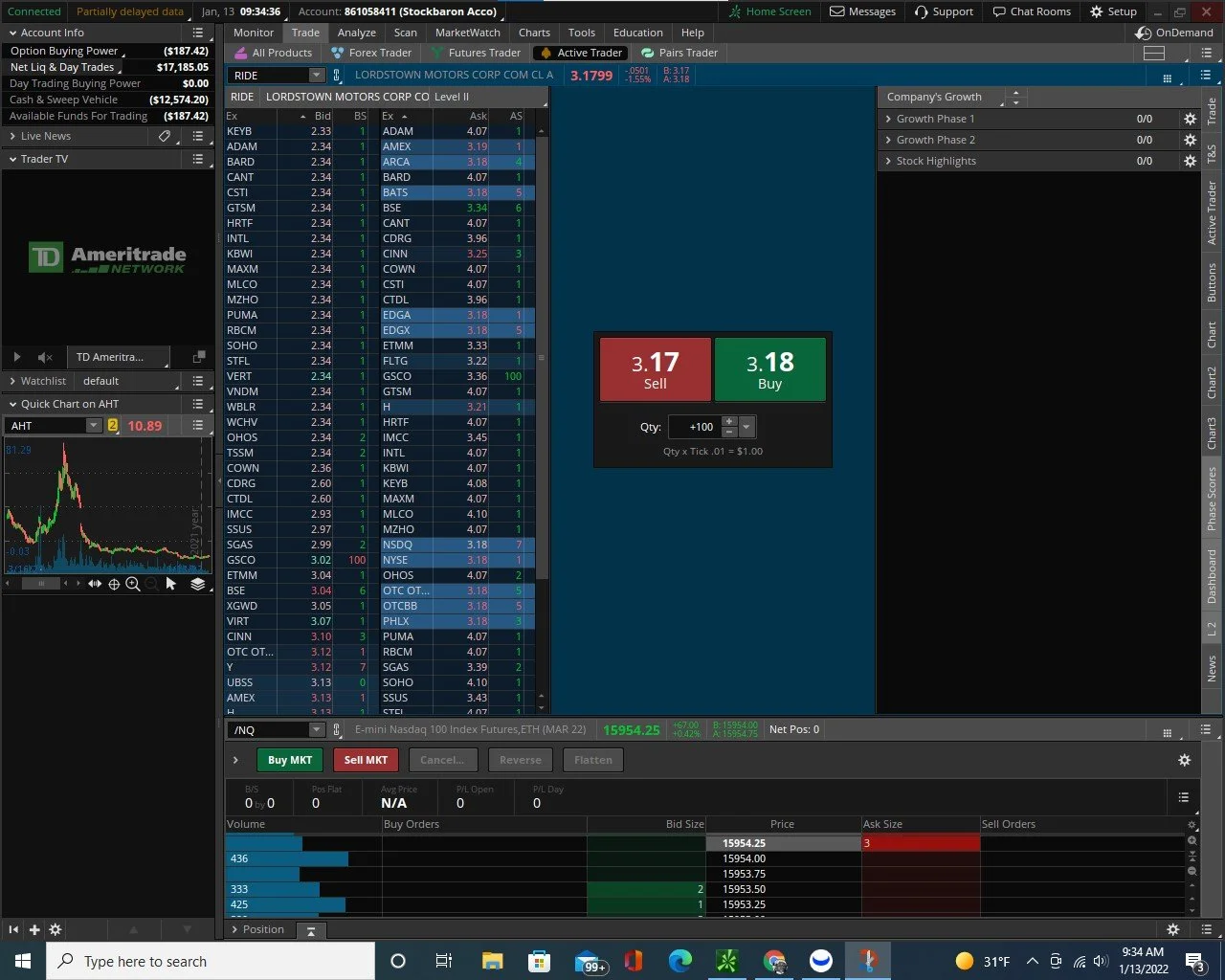

Picture Below was Taken on October 11, 2021 at 3.10 PM.

The video shows the three stocks that comprised 100 PERCENT of all my portfolios on October 11, 2021 at 3.10 PM. My TradeStation Securities App chart had 22 stocks. October 11, 2021 was a heavily bullish day with every stock in the green. Every stock in that chart was green except for the THREE STOCKS that constituted 100 Percent of my portfolio. I have several more recordings of similar manipulative scheme of attacks on me, including on the day Lordstown Motors announced the Foxconn deal, and the day Dan Ninivaggi was announced as CEO.

-

By October 18, 2021, after repeatedly manipulating my various portfolios to keep my account down on any day that the market was up, and push the account lower on any day the market was down, the fraudulent market makers stared manipulating options that underlay my accounts. This would continue for the next three months. Please see the video section for the options manipulation from October 18th.

Prelminary Videos

Synchronized Manipulation of Lordstown Motors and Ashford Hospitality Trust by the Market Maker Gang

Pattern, Timeline and Goal of Market Maker Synchronized Manipulation of RIDE and AHT on 12/16/2021

RAW VIDEO: Market Makers Willfully Manipulating Lordstown Motors etc, to Destroy My Webull Portfolio

Fraudulent Market Makers Manipulating Account Value on December 1, 2021

December 10: Fraudulent Market Makers Manipulating NAV When Securities are all Higher

December 30: Webull Account Sold off $25933 Negative Territory as Stocks in Account Rocked Higher

$158,873 Stolen at WEBULL!!!

From November 2020 to January 2021, I deposited $158,873 at Webull Financial Inc. The account grew to $340,000 by July 2021. The collusive attacks started. On January 21, 2021, the account value printed: -$4459!!!

The above E-Mail was a response from Webull to my complaint dated November 26, 2021. It came from Frank DeAndrea, Webull’s Director of Compliance. Over 100 gigabytes of additional data were sent to Webull. The company made the choice which was communicated to me almost six weeks later. In that interim, the company was force-selling securities in the account. More on this later. Suffice it to say that the destruction of my Webull portfolio was accomplished on January 21, 2022. Again, more on this later!